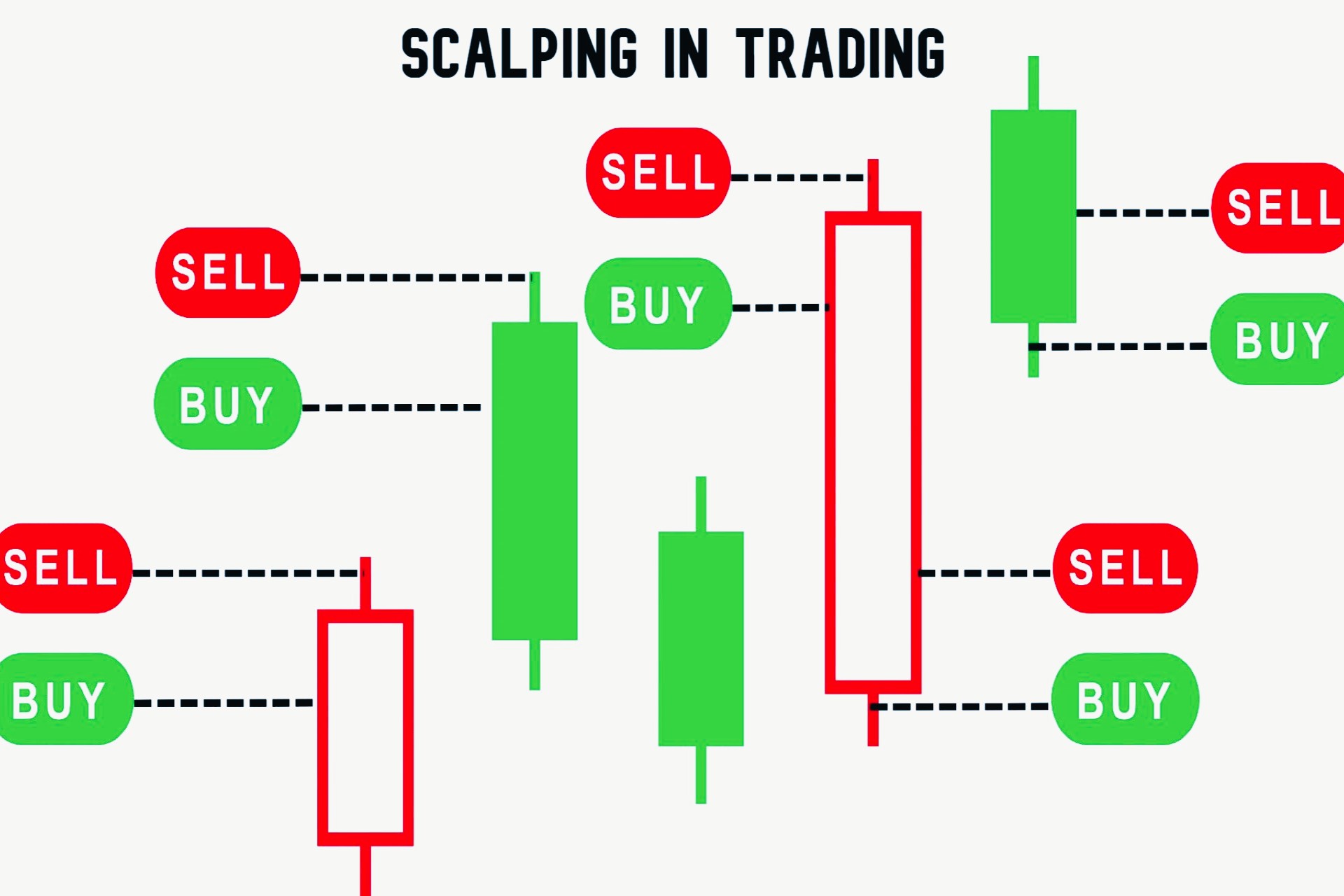

If you’re diving into the world of day trading, you might have come across the term “scalping.” But what does it really mean? Simply put, scalping is a trading strategy aimed at making small profits from quick trades. Day traders who use scalping strategies are often looking to take advantage of minute price changes throughout the day. Let’s break it down and see how it works and whether it’s the right approach for you.

Scalping Strategies

Scalping is a trading style focused on executing a large number of trades to capture small price movements. Imagine a fisherman casting his net repeatedly, hoping to catch many small fish rather than chasing after a single large one. That’s scalping in a nutshell! Scalpers aim to profit from tiny fluctuations in the market, making quick trades that typically last from a few seconds to several minutes. This approach demands constant attention and rapid decision-making, making it a high-pressure strategy.

Scalping not only provides opportunities for quick profits through numerous trades but also requires traders to maintain a high level of discipline and strategic thinking. Successful scalpers often rely on various tools and analytical methods to make split-second decisions. These can include technical analysis, chart patterns, and trading indicators. It’s essential to understand that while this style of trading can be profitable, it may not be suitable for everyone, as it requires sustained focus on market movements and the ability to adapt quickly to changing conditions.

Importance of Scalping in Day Trading

Scalping can be an invaluable tool for day traders. By making quick trades, scalpers can benefit from minor price changes while avoiding the risks associated with holding positions overnight. For traders seeking to maximize their profits in a volatile market, scalping can be an attractive strategy. The ability to enter and exit trades swiftly allows scalpers to capitalize on fleeting opportunities that others might miss, making it a dynamic and potentially lucrative approach.

Moreover, scalping offers traders the chance to work with smaller capital compared to other trading strategies. This accessibility allows beginners to enter the market without needing a large financial commitment. Additionally, by closing all positions within the same trading day, scalpers minimize their exposure to unexpected market fluctuations caused by news events or economic data releases that occur outside of trading hours. However, despite its advantages, scalping demands significant effort and concentration, making it a more suitable option for active traders who thrive in fast-paced environments.

Common Scalping Techniques

Scalping encompasses various strategies that traders can utilize to capitalize on minor price movements. Each technique has its unique characteristics and can be tailored to fit different market conditions and trader preferences. The three most common scalping techniques are Market Making, Momentum Trading, and Arbitrage. Let’s explore each of these techniques in more detail.

Market Making

Market making is a crucial component of financial markets, as market makers help ensure liquidity by continuously buying and selling assets. These traders quote both buy and sell prices for a particular security and profit from the bid-ask spread—the difference between the price at which they buy (bid) and the price at which they sell (ask). For scalpers, market making can be an effective strategy for generating small but consistent profits through high-frequency trading.

Key Features of Market Making:

- Liquidity Provision: Market makers facilitate trading by ensuring there is always a buyer and seller for an asset, which helps reduce volatility.

- Bid-Ask Spread: Profit is generated from the difference between the buy and sell prices. The narrower the spread, the more trades can be executed, increasing potential profits.

- High Trading Volume: Scalpers execute a large number of trades throughout the day, aiming for small profits that can accumulate.

To succeed as a market maker, scalpers must be adept at monitoring market conditions and reacting quickly to price changes. They often utilize advanced trading platforms equipped with algorithms that automate order execution. However, this strategy also involves risk, as significant price movements can lead to losses if not managed correctly.

Momentum Trading

Momentum trading is a popular scalping technique that focuses on stocks that are experiencing significant price movements in one direction. Traders look for assets that are either rapidly increasing or decreasing in price and attempt to capitalize on this momentum for short-term gains. The key to this strategy is timing—catching the upward or downward momentum just right can lead to quick profits.

Key Features of Momentum Trading:

- Identifying Trends: Traders use technical analysis to spot stocks that are exhibiting strong price trends, often using indicators such as moving averages and volume analysis.

- Quick Execution: Momentum trades are typically short-lived, requiring traders to act swiftly to take advantage of fleeting opportunities.

- Risk Management: Setting stop-loss orders is crucial to protect against sudden reversals in price, which can happen rapidly during volatile market conditions.

Successful momentum traders often keep an eye on news and market events that may drive significant price changes. For example, an earnings report or a major product announcement can create momentum, providing scalpers with the opportunity to enter and exit trades quickly. The challenge lies in accurately predicting when the momentum will shift, as holding a position too long can result in losses.

Arbitrage

Arbitrage is a strategy that involves taking advantage of price discrepancies for the same asset across different markets or exchanges. Scalpers who use arbitrage aim to buy an asset where the price is lower and sell it where the price is higher, profiting from the difference. This strategy requires precision, speed, and access to multiple trading platforms to execute trades effectively.

Key Features of Arbitrage:

- Price Discrepancies: Traders look for situations where an asset is undervalued on one exchange and overvalued on another, allowing them to make a profit with minimal risk.

- Speed and Timing: Opportunities for arbitrage can disappear quickly, so traders must act fast to capitalize on these price differences.

- Market Efficiency: Arbitrage opportunities often arise in less efficient markets or during periods of high volatility, making them ideal for scalpers looking for quick profits.

There are several types of arbitrage, including:

- Spatial Arbitrage: Buying and selling an asset across different exchanges.

- Statistical Arbitrage: Using statistical models to identify price discrepancies based on historical relationships between assets.

- Triangular Arbitrage: In the foreign exchange market, this involves converting one currency into another through multiple transactions to exploit discrepancies in exchange rates.

While arbitrage can be a lucrative scalping technique, it requires a strong understanding of market mechanics and often involves higher transaction costs. Traders must also be vigilant about potential risks, such as slippage or changes in market conditions that could impact profitability.

Pros of Scalping Strategies

High Frequency of Trades

One of the standout advantages of scalping is the ability to execute a high frequency of trades within a single day. Scalpers aim to take advantage of small price movements, which often leads to dozens, if not hundreds, of trades daily. This relentless pace allows traders to capitalize on numerous opportunities in a volatile market, where price fluctuations can happen in the blink of an eye. The more trades a scalper makes, the greater the potential for profit, as even the tiniest gains can accumulate quickly throughout the day.

Moreover, this high turnover rate can also be psychologically rewarding for traders who thrive on activity and engagement. The excitement of making quick trades can create a sense of accomplishment and satisfaction, making scalping an appealing strategy for those who enjoy a fast-paced trading environment. However, this constant activity can also lead to fatigue, requiring traders to remain disciplined and focused throughout their trading sessions.

Potential for Quick Profits

Scalping is inherently designed for traders looking for quick wins. Unlike traditional investing, which may involve holding assets for extended periods to realize gains, scalping focuses on short-term price movements. If executed effectively, scalpers can realize profits within seconds or minutes of entering a trade. This immediacy can be highly appealing, especially for traders who have a lower risk tolerance or prefer not to expose themselves to overnight market risks.

The thrill of fast-paced trading can be exhilarating for those who enjoy high-stakes environments. Scalpers often find that the adrenaline rush of watching the market and making rapid decisions keeps them engaged and motivated. Quick profits can also provide traders with immediate feedback on their strategies, allowing them to adjust their techniques in real time based on market performance. However, it’s essential to remember that while quick profits are a significant benefit, they require a high level of skill and precision to achieve consistently.

Lower Exposure to Market Risk

Another significant advantage of scalping is the reduced exposure to market risk. Since scalpers hold positions for a very short duration—often just minutes—they are less vulnerable to significant market fluctuations that can occur overnight or over longer periods. This short holding period acts as a safety net, especially in unpredictable markets where prices can swing dramatically based on news events or economic data releases.

By minimizing the time spent in the market, scalpers can protect their capital from adverse movements that may affect longer-term investors. This characteristic makes scalping particularly appealing during periods of high volatility, where traditional strategies may incur greater risk. However, while this lower exposure can safeguard against major losses, it doesn’t eliminate risk entirely; sudden price movements can still impact scalpers if they don’t manage their trades carefully.

Cons of Scalping Strategies

Time-Intensive and Demanding

While scalping offers various advantages, it’s not for everyone. One of the most significant drawbacks is that it is time-intensive and mentally demanding. Scalpers must dedicate a substantial amount of time to monitoring the markets, analyzing price movements, and executing trades. This constant engagement can be mentally exhausting, as traders must remain focused and alert for extended periods, often for the entire trading day.

The need for quick decision-making also adds pressure. Scalpers must analyze multiple factors in real-time, including market conditions, price patterns, and technical indicators, to determine when to enter and exit trades. This level of intensity can lead to fatigue and burnout, especially for those who are not accustomed to high-pressure trading environments. Moreover, if a scalper experiences a series of losses, the emotional toll can compound, leading to hasty decisions and further losses.

High Transaction Costs

Another challenge of scalping is the high transaction costs associated with executing a large number of trades. Since scalpers aim to profit from small price movements, they often trade in high volumes, which can result in substantial costs related to commissions and fees. Over time, these costs can accumulate and eat into the profits generated from successful trades, making it essential for scalpers to consider the impact of transaction costs on their overall profitability.

To mitigate these expenses, scalpers must carefully choose their trading platforms and brokers, looking for those that offer competitive commission rates. Additionally, they should analyze their trading strategies to ensure that the potential profits outweigh the associated costs. However, the need to balance frequent trading with cost efficiency can complicate the scalping process, requiring traders to remain vigilant about their expenses.

Risk of Significant Losses

While the potential for quick profits is appealing, scalping also carries the risk of significant losses. The market can move against a trader just as swiftly as it can move in their favor, leading to rapid declines in capital. Scalpers must be prepared for this possibility, as even a single bad trade can result in substantial financial loss. This inherent risk requires effective risk management strategies, such as setting stop-loss orders to minimize potential damage.

Moreover, the fast-paced nature of scalping can lead to impulsive decision-making, particularly during moments of high volatility. Traders may find themselves holding onto losing positions for too long, hoping for a reversal that may not come. This emotional aspect of trading can further exacerbate losses, highlighting the importance of maintaining discipline and sticking to a well-defined trading plan. Ultimately, while scalping can offer lucrative opportunities, it also requires careful consideration of the risks involved.